Barfoot & Thompson's latest monthly update made me chuckle when I read there was a "strong performance from the Auckland housing market as it heads into the year end."

This and other comments in the report reminded me of the comment in the Now You See Me movie: "The closer you look, the less you see." Here is the YouTube video of the relevant part of the movie.

Being the time of year to let one's hair down a little I decided to comment on Barfoot & Thompson's assessment of the strength of the Auckland market by putting it in the proper perspective.

The conclusion of my independent assessment is that the Auckland market is weaker than average especially in terms of the performance of prices. The demand-supply balance shown below doesn't justify much if any upside in prices in the near-term and the analysis in our pay-to-view reports suggests this won't change much in 2019.

"The closer you look, the less you see" may also apply to the housing market

Barfoot & Thompson (B&T) provides a useful service with monthly updates of the company's sales in its housing market updates as well as providing other insights each month.

The recent report presenting the November insights was titled: "Strong performance from Auckland housing market as it heads into the year end" and went on to say:

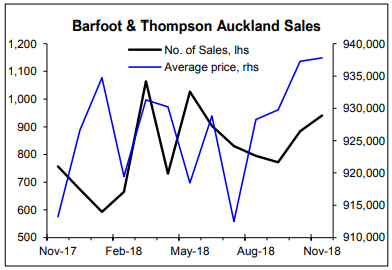

"The Auckland housing market is ending the calendar year strongly with sales numbers in November their highest in six months, and with the average price at its highest in 12 months."

The chart below shows the number of sales and average house prices reported by B&T for the last 12 months. November sales are the highest in six months and the average November sale price is the highest in 12 months. But to call this a "strong performance" is a bit of a stretch.

When put in the proper perspective the Auckland market is weaker than average

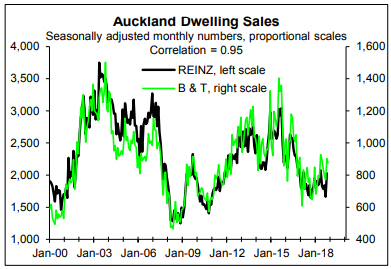

The next chart that takes in the big picture in terms of monthly sales reported by B&T and REINZ for Auckland put things in proper perspective. It also uses seasonally adjusted numbers that is important when comparing over periods like six months as done by B&T. House sales experience a strong seasonal pattern, generally increasing in the months leading up to November before tumbling in December.

B&T sales at 874 seasonally adjusted in November were still a bit below the average of 904 since January 2000. In November sales were marginally weaker than average rather than "strong" (chart below). The seasonal adjustment was done using a reasonably basic package.

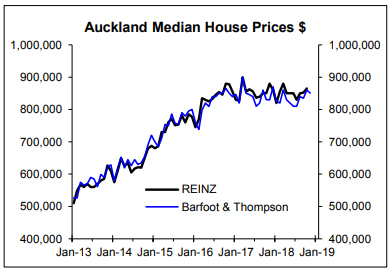

Monthly average house prices get kicked around lots by changes in the composition of sales so should be largely ignored even when comparing movements over 12 months. Median prices are better but still get kicked around quite a bit by changes in the composition of sales which is why REINZ now produces monthly house price indices that adjusts for changes in the composition of sales.

In the context of the median Auckland house prices reported by B&T and REINZ the recent increases most likely reflect changes in composition of sales with the general picture being little change in prices since the peak in late-2016 (next chart).

Over the last 12 months the B&T median price increased 2.5% vs. an average annual increase in the REINZ Auckland House Price Index since 2000 of 7.2%. 2.5% versus 7.2% suggests the Auckland market is much weaker than average in terms of house price performance; definitely not justifying the recent performance being labelled strong.

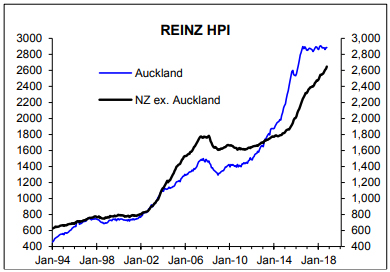

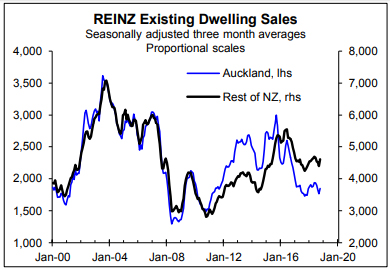

If the Auckland market is "strong" the rest of NZ must be in a mega-boom based on the relative level of sales (next chart) and the same for house prices. But we shouldn't blame B&T for putting a positive spin on the state of the Auckland market given the tough time it has had and largely continues to have.

Important to put things in perspective and get quality, independent insights

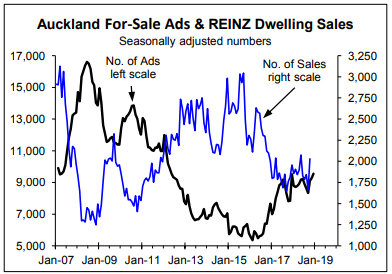

This little episode reinforces the value of viewing things in a full or proper perspective and getting independent insights. In our Auckland and national housing reports we quantify the demand-supply balance in the Auckland market using the following chart; one of two we use. It shows the level of sales reported by REINZ vs. the level of for-sale listings on www.realestate.co.nz; both seasonally adjusted to better show the underlying picture. Sales largely reflect demand and for-sale listings largely reflect supply. At the moment the Auckland demand supply balance struggles to justify much if any upside in prices. And consistent with that the REINZ Auckland House Price Index has been bobbling sideways (top right chart).

Consistent with a much stronger demand-supply in the rest of the country on average the REINZ NZ ex. Auckland HPI has been increasing solidly.